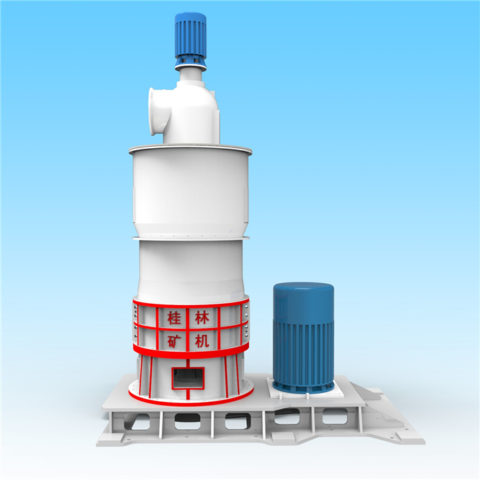

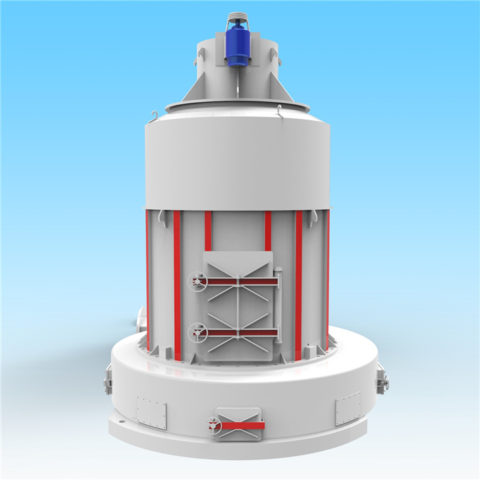

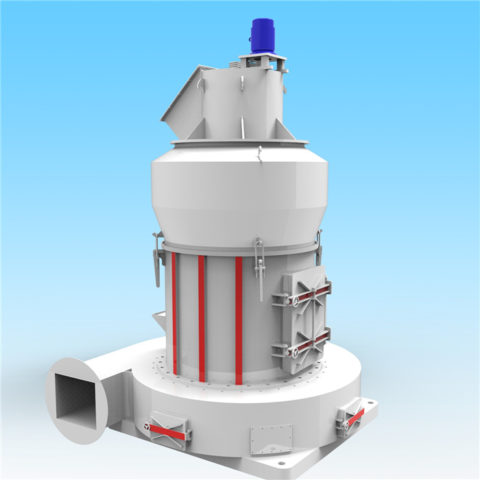

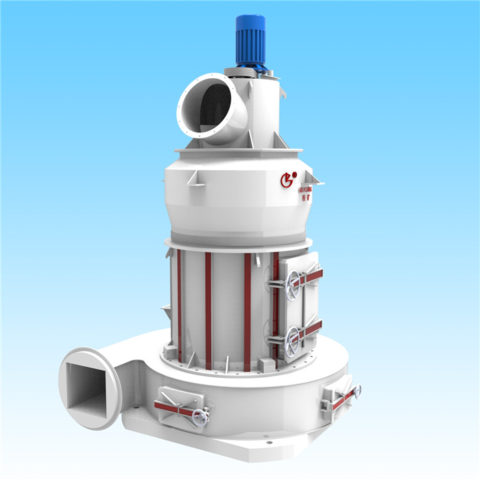

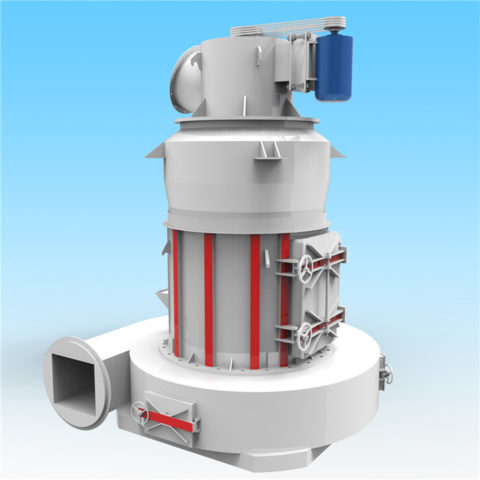

Chinese Raymond mills (Raymond grinding mills) have gained substantial international recognition for their cost-efficiency, adaptability, and compliance with sustainability standards, securing demand across diverse industrial sectors worldwide. Below is an analysis of key markets prioritizing these grinding systems:

1. Southeast Asia & Africa

Small-Scale Mining Dominance: Compact models (5–8 t/h) are widely adopted in Indonesia, Vietnam, and Kenya for processing gold ore and limestone. Localized production hubs in Vietnam reduce lead times by 70%, outperforming European counterparts in affordability.

Agricultural Applications: Philippine and Nigerian agro-industries utilize Raymond mills for producing 200–300 mesh fertilizers from phosphate and kaolin.

2. Middle East

Construction Material Production: UAE cement plants leverage Chinese Raymond mills to grind recycled concrete into 300-mesh additives, achieving 28% faster curing times. Saudi Arabia imports high-capacity models (20–25 t/h) for gypsum processing in drywall manufacturing.

3. Americas

Resource-Rich Economies: Chile and Peru rely on these mills for copper and lithium concentrate grinding, benefiting from IoT-enabled predictive maintenance that reduces downtime by 75%28.

U.S. Market Resilience: Despite geopolitical tensions, American construction firms prioritize Chinese Raymond mills for their 40% lower operational costs compared to domestic brands.

4. Europe

Green Industrial Compliance: Germany and Poland import ISO 14067-certified models to process industrial minerals (e.g., barite, bentonite) while meeting EU Scope 3 emissions regulations. Energy recovery systems cutting power consumption to 0.8 kWh/ton enhance their appeal.

5. Emerging Economies

Central Asia: Kazakhstan’s mining sector uses modular Raymond mills for polymetallic ore grinding, valuing rapid component interchangeability.

South Asia: Indian ceramic manufacturers depend on these mills to produce 400-mesh zircon sand, supported by AI-optimized grinding precision.

Competitive Drivers

Price-to-Performance Ratio: Chinese mills are 50% cheaper than German or Japanese equivalents, with comparable output quality.

Customization Capabilities: Adjustable blade angles (15°–90°) and hybrid energy systems cater to regional material variances, from Vietnam’s humid limestone to Chile’s abrasive copper ore.

As global industries prioritize cost-effective and eco-friendly solutions, Chinese Raymond mills are projected to dominate 22% of the grinding equipment market by 2030, driven by robust demand in resource-processing and green construction sectors